Photo by images72/Shutterstock.com

The largest overhaul of the U.S. tax code in three decades went into effect this year, impacting farmers, ranchers and other rural landowners in a variety of ways. For the most part, financial experts anticipate benefits for these groups.

“The increase in the exemption in estate and generation-skipping taxes to $11.2 million in 2018 will allow more farmland to be passed to future generations with less or no estate tax.”

–Burl D. Lowery, CPA

“The 2018 tax law changes include several items that I feel will be beneficial to agricultural producers,” says Burl D. Lowery, a Brownwood, Texas, certified public accountant (CPA) and a director of Central Texas Farm Credit. “The increase in the exemption in estate and generation-skipping taxes to $11.2 million in 2018 will allow more farmland to be passed to future generations with less or no estate tax.

Lowery and fellow CPA John R. Adams, a director of Alabama Farm Credit, point to several key changes they believe could reduce the tax burden on some farmers. These include:

- A 20 percent deduction for pass-through income

- Extension of the bonus depreciation on capital purchases, allowing a 100 percent write-off on new or used equipment in the year of purchase

- An overall reduction in tax rates

- A new flat tax rate for corporations

“While simplification was a goal of tax reform, much complexity still remains,” says Adams, who is with the accounting firm of Byrd, Smalley & Adams in Decatur, Ala. “For that reason, it is imperative that producers begin the planning process now with their tax advisors.”

Following are some of the provisions of the Tax Cuts and Jobs Act that will affect agricultural producers in 2018.

Individual Tax Brackets

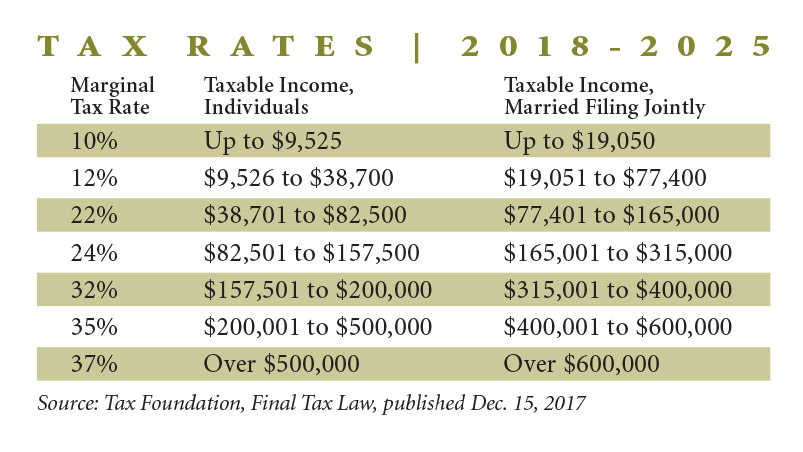

The new federal tax law was expected to change some of the individual tax-rate brackets and adjust the bracket amounts. While the total number of brackets remains at seven, the top rate will fall from 39.6 percent to 37 percent, and the amount of income covered by the lower brackets has been adjusted. This is significant as the vast majority of farmers pay taxes as individuals.

Source: Tax Foundation, Final Tax Law, published Dec. 15, 2017

Standard Deduction

The standard deduction for individuals increases to $12,000 for single filers and $24,000 for joint filers.

Section 179 Depreciation Deduction

Beginning with the 2018 tax year, farmers will be allowed to immediately write off capital purchases, including breeding livestock, farm equipment and single-purpose structures, such as milking parlors, up to $1 million dollars. The phase-out of this expensing provision does not kick in until a farm reaches $2.5 million in purchases.

Bonus Depreciation

Farmers will now be able to write off 100 percent of qualified property purchased after Sept. 27, 2017, through the year 2022, at which time a phase-down occurs.

The new law expands bonus depreciation to include both new and used property that is purchased or constructed. The 100 percent deduction also applies to fruit- and nut-bearing plants that are planted during the year.

It is important to note that many states do not conform exactly to the federal bonus and Section 179 depreciation provisions. For example, a farmer expensing 100 percent of a $3 million capital purchase with bonus depreciation may not receive that $3 million deduction at the state level.

Farm Equipment

Farm machinery and equipment (other than grain bins, fences or other land improvements) will be eligible for depreciation over five years, rather than the previous seven years, as long as the original use of the asset begins with the taxpayer.

Like-Kind Exchanges

Like-kind exchanges are limited to real property. For example, farmers can still swap land for other land tax-free, but equipment trade-ins will no longer be tax-free events.

$25 Million Interest Deduction Limitation

Businesses, including farms, will now be limited on interest-expense deductions when their gross receipts exceed $25 million. If applicable, the interest deduction cannot be more than the business interest income plus 30 percent of adjusted taxable income. Taxable income is computed without regard to certain adjustments, such as business interest expense and net operating losses.

Farmer cooperatives and other farming businesses may elect to be exempt from the interest-expense limitation. In exchange, such businesses may use an alternative 10-year depreciation system.

There is an election that farmers may consider in order to avoid the limitation. The catch, however, is that a slower alternative depreciation system will have to be used on farm property with a recovery period of 10 years or more, such as greenhouses and barns. Farmers will be permitted to carry interest forward indefinitely, subject to some pass-through limitations for partnerships.

Corporate Tax Rate

Although the new flat tax rate will benefit most farmers by decreasing their tax rate, some farming corporations that fall within a 15 percent tax bracket may actually see a tax-rate increase. Those producers may want to visit with their accountants or attorneys about possible tax advantages to modifying their corporate structure.

Cash Method Accounting

Farmers with average gross receipts (more than three years) under $25 million will be permitted to use the cash method of accounting. Additionally, these taxpayers will not be required to account for inventories under Section 471. However, cash-basis taxpayers will not be able to deduct inventory until sold. The uniform capitalization rules are also removed for taxpayers under the $25 million threshold.

Net Operating Losses

The law limits net operating losses (NOLs) to 80 percent of taxable income. Farmers are permitted a two-year NOL carryback.

“It is imperative that producers begin the planning process now with their tax advisors.”

–John R. Adams, CPA

Domestic Production Activities Deduction

The Section 199 domestic production activities deduction (DPAD) has been repealed. As a result, some cooperatives may accelerate that pass-through deduction to patrons before year end.

Estate Tax

The federal estate tax exemption rate will double to approximately $11.2 million per individual and $22.4 million for married couples in 2018. These increased amounts will sunset on Jan. 1, 2026.

Deductions for Cooperatives

The tax bill eliminated the Section 199 tax deduction for domestic production activities income used by farmer-owned co-ops and typically passed on to their member-owners. It was replaced by Section 199A, which provides a pass-through deduction for virtually all entities other than corporations.

As originally written, Section 199A included a 20 percent deduction on all payments from a farmer co-op to its members, a provision to which owners of private grain elevators objected. In March, the omnibus spending bill corrected the so-called grain glitch.

The “fixed” version of 199A essentially puts Section 199 back into the code, so that it operates as closely as possible to the “old” 199. Under the new version, co-op members calculate their own deduction, and can also receive a pass-through deduction from the co-op. One significant change in the new law is that taxpayers structured as C corporations are not eligible for the 199A deduction.

Noncorporate Taxpayers

Like cooperatives, noncorporate taxpayers will get a 20 percent deduction that may be used to offset ordinary income.

Of concern, much like the DPAD that is being repealed, are limitations associated with the noncorporate taxpayers’ 20 percent deduction, such as the amount of wages and unadjusted tax basis the businesses have. The cooperative members’ deduction has limitations as well.

These limitations are somewhat complicated, and certain provisions remain unclear as to their mechanics. Additionally, the deduction only offsets income tax, not self-employment tax. One of the concerns with the deduction is that it may be of little use to dairy farmers who cull cows, since any capital gain sales, such as raised cows, limits the impact of the deduction.

Breweries, Distilleries and Wineries

Alcohol manufacturers will enjoy a reduction in excise tax for the next two years. The new legislation also excludes the aging periods for beer, wine and spirits from the production period with regard to the uniform capitalization (UNICAP) rules, thereby allowing deductions over a quicker time frame. The credit against the wine excise tax also was expanded. Sparkling wine producers are included.

The Affordable Care Act

The Affordable Care Act (ACA) was not repealed with the new tax provisions. While the individual health insurance mandate technically remains, the penalty has been reduced to $0, effectively rendering it moot. However, beginning in 2019, other aspects of the ACA, including the employer mandate, remain in place as before.

–Article courtesy of Farm Credit East

Adapted from an article titled “What the New Tax Law Means for Northeast Agriculture,” published at FarmCreditEast.com in December 2017 and updated in 2018. Contributors: Dario Arezzo, Joseph Baldwin, Paul VanDenburgh, Christopher Laughton, Kristine Tidgren, Tiffany Dowell Lashmet and Marlis Carson

Disclaimer: The information in this report has been compiled from sources believed to be reliable. This is provided for general information purposes only and is not market advice. Farm Credit Bank of Texas makes no representation or warranty regarding the content presented.