Photo by Kanokwalee Pusitanun

How much is your land worth?

To you it might be the most valuable property in the world, but unless you have hard data on market trends in your area, you’ll never know for sure. Fortunately that kind of information is available for several states thanks to a friendship forged over 50 years ago.

Back in the mid-1960s, three Texas Aggies with a love of agricultural economics — George Cunningham, president of the Federal Land Bank of Houston, and Texas A&M University professors Dr. A.B. “Pat” Wooten and Dr. Ivan W. Schmedemann — agreed to share resources so people could have more information about land markets. It was a perfect partnership: Cunningham’s bank had information on land sales, and Wooten and Schmedemann taught real estate professionals, rural appraisers and Farm Credit employees how to assess land values.

The agreement lives on between the bank, now called Farm Credit of Texas (FCBT), and the Texas A&M University Real Estate Center (REC), the nation’s largest publicly funded organization devoted to real estate research. The center tracks trends in land prices, tract sizes and sales volumes by analyzing information provided by the bank and 14 affiliated lending cooperatives, also called associations, in Alabama, Louisiana, Mississippi, New Mexico and Texas.

“The research agreement allows us to do things that no other center in the country can do,” says REC Director Gary Maler. “We are always on the hunt for new ways to look at the economic drivers of real estate activity. Quality data is critical, and this is the most consistent data that exists in land markets. That’s a big deal.”

Why Land Value Trends Matter

Understanding Behavior

Data can clue you in to what’s motivating buyers and sellers. A slowdown in sales could suggest buyers think land prices are too high, or that they have other priorities such as recovering from a big storm.

“People tend to focus on prices, but I think volume indicators give you a more complete picture,” says Dr. Charles Gilliland, a research economist with the Texas A&M University Real Estate Center.

Searching for Property

Market data can help buyers narrow their search based on region, budget and goals.

“They can look at relative prices on our website and see the direction the market has been taking,” Gilliland says. “It’s not designed to be the price of any specific property. They’ll want to talk to somebody local, because there’s really no substitute for boots on the ground when it comes to understanding the real estate market.”

Financial Planning

Land values are one measure of overall wealth.

“If you keep up with the trends, you’ll have an idea what your property is worth and how it’s changed over time,” Gilliland says. “There are all kinds of ways that can impact you from a business standpoint. One is your tax situation — both inheritance taxes and the market value that local authorities are assigning to your property for property taxes.”

Estate Planning

Market trends can guide decisions about what to do with your property.

“People see land as an investment or a way to provide for their families,” says Tyler Mullins, senior appraiser for Mississippi Land Bank. “They want an asset that’s increasing in value — whether they plan on transferring it to their children or selling one day. If they see a trend that indicates they need to do something, they can make their decisions based on current market data.”

Appraising Accurately

Appraisers look at sales in the immediate area and overall market trends to arrive at a property’s value.

“Collecting sales data allows us to stay current with values when we’re appraising property,” says Jeff Royal, collateral risk manager for Lone Star Ag Credit. “The reports from the Real Estate Center can reinforce that by verifying trends in the market.”

Making Loans

Lenders monitor collateral’s value so they can maintain healthy loan portfolios. The five-state Texas Farm Credit District uses indexing rather than survey data or benchmark appraisals, which are more subjective.

“Benchmarking hinges on appraising a typical property from a market area, but a typical property is very hard to find, when you get right down to it,” says Brad Swinney, FCBT vice president of collateral risk management. “Our unique relationship with the Real Estate Center helps us exceed what we could do benchmarking. That is worth its weight in gold to us.”

Sales Data vs. Surveys

Landowners, real estate agents, appraisers, lenders, tax accountants, estate planning attorneys and others are hungry for market information that is accurate, current and objective.

“We look at everything that moves through the market,” says Dr. Charles Gilliland, the center’s rural land expert. “There are a lot of dynamics going on beneath those numbers. Sometimes we see a trend before the guys on the ground notice anything.

“It’s a unique situation. Most of the data at other universities is based on opinion, on surveys.”

Surveys — such as USDA surveys of farmers or Federal Reserve Bank surveys of ag bankers — can be useful, but are subjective and easily outdated. It’s human nature to find declining values hard to accept or be overly optimistic that they’ll go up.

“Having transactional data, we can present what’s actually going on in the market,” says Dr. Erin Kiella, a former consultant for the Federal Reserve Bank of Chicago who joined the REC in January as assistant research scientist. “You can see the demand for that in the Annual Outlook for Texas Land Markets conference that the center puts on. We have close to 500 people coming from all over the state to hear Charley’s market update, which comes directly from our work with Farm Credit.”

Reliable Data Is in Demand

One reason the information is in such demand is because sales prices are not publicly disclosed in some states, such as New Mexico, Mississippi and Texas.

“In a nondisclosure state, it can be extremely difficult to get verified information about prices,” says Jeff Royal, collateral risk manager for Lone Star Ag Credit, a Farm Credit association based in Fort Worth, Texas. Gilliland adds that even in disclosure states such as Alabama and Louisiana, sales data isn’t routinely gathered in one place.

“What the Real Estate Center does is envied across the country,” Royal says. “They have a good pulse on land markets because they have access to all the data.”

The information comes from transactions financed by Farm Credit associations, which have a large market share of rural real estate mortgages. Associations supplement that with leads from real estate agents, appraisers and Lands of America, the country’s largest rural listing network.

“It’s very important to have data outside just what the associations finance because we don’t want to be seen as setting the market,” says Tyler Mullins, senior appraiser at Mississippi Land Bank in Senatobia, Miss. “We enter any and all sales that we can find. After the Real Estate Center analyzes our data, that information can show us what our market is doing in real time.”

Much of the data is available to the public, which can use the center’s website to find Texas land market information dating back to 1966, and will soon see Alabama, Louisiana and Mississippi data going back to 2000. The center also does some research on the New Mexico market.

Every market is different, so states are divided into regions — seven in Texas; four apiece in Alabama and Mississippi; and one each in Louisiana and New Mexico — that capture meaningful data about local activity.

The Meaning Behind the Numbers

The decades of data have provided valuable insight into consumer behavior and market drivers such as oil prices, personal income and interest rates. Researchers also can look at the numbers in new ways as technology evolves.

Currently the center is using geospatial analysis to map sales activity that has been shifting toward counties with lower priced land as buyers look for a good deal. It can also look at correlations with land use, housing activity, flood zones and other factors.

“Data is our life, so we hang onto it, and it makes these long-time series over multiple cycles possible,” says Gerald Klassen, the center’s research data scientist. “We’re going to nominate Charley for a ‘Hoarders’ episode.”

Gilliland admits he’s fascinated by the way dynamics constantly change, like when demand for sand mining temporarily sent land prices into orbit in parts of Far West Texas last year.

“That’s why we use median prices,” Gilliland says, describing just one way the center keeps seasonal, regional and other variations from distorting the big picture. “If you do an average, a great big number makes a great big difference, but a median is based on a ranking from highest to lowest. It’s more indicative of what is typical for the region.”

A Look Back at Rural Land Value Trends

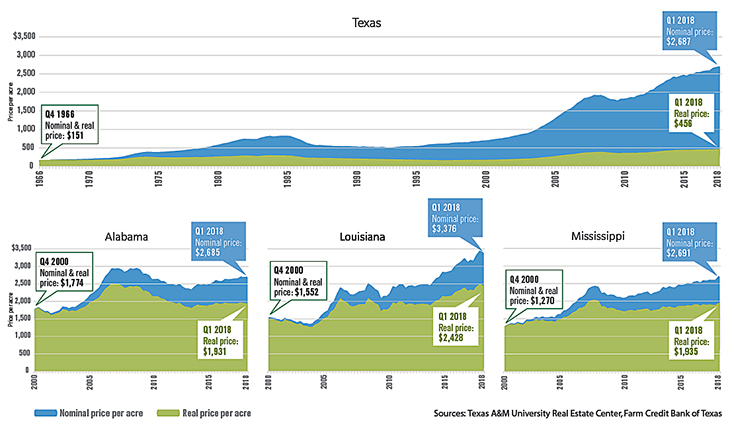

The Texas A&M University Real Estate Center analyzes sales data provided by Farm Credit lenders, and publishes median price, tract size, sales volume and the rate of change on its website. In these statewide four-quarter moving average prices, nominal price (top line) reflects dollar amounts at that time, and real price (bottom line) is adjusted for inflation back to the year the data started being collected — 1966 for Texas and 2000 elsewhere.

“Real prices indicate whether current prices are high or low from a historical standpoint,” says Dr. Charles Gilliland of the Real Estate Center.

View a larger version of the image

Sources: Texas A&M University Real Estate Center, Farm Credit Bank of Texas

Benefits for Portfolios and the Public

Lenders watch trends closely because they need to know the value of collateral and what might happen if conditions change. The REC helps the five-state Texas Farm Credit District manage collateral risk through stress testing, special studies and indexing.

“If you buy land today in Texas, real prices are telling you that a typical acre of land will cost you more than it would have at any time since 1966.”

–Dr. Charles Gilliland

“The Real Estate Center calculates the trend in price going back several years, and applies an index so we don’t have to reappraise everything to get a current value,” Royal says. “We’re fortunate that we can use their indices to see how the portfolio is performing and address any negative trends before they become a problem. It gives our customers reassurance, and is something our regulator wants to see.”

Indexing is very accurate and objective compared with other collateral risk management methods. It’s also a huge cost savings because benchmarking, the most likely alternative, would require thousands of dollars in appraisals each year, reducing associations’ earnings and borrowers’ patronage refunds.

The REC’s research is funded by real estate license fees in Texas.

“The top real estate program in the country among public universities is indexing the associations’ portfolios for them,” says Brad Swinney, FCBT vice president of collateral risk management. “They’re getting that level of insight and analysis into land markets without the expense. Imagine trying to hire all those Ph.D. economists and keep them on staff.”

The partnership is a win for Farm Credit and a win for the center, which has a mission to help people make better real estate decisions.

“We’re exchanging our expertise for access to data,” Maler says. “The benefit isn’t just for us. Healthy markets are good for everybody. We’re aggregating data so folks have some guidance on prices.”

–Staff

Resources for Land Values

Here are some ways to learn more about land values in your area.

- Texas A&M University Real Estate Center: The research center has Texas land market data going back to 1966, and will soon publish Alabama, Louisiana and Mississippi data going back to 2000. A user guide explains how to use the information — under Rural Land in the website’s Data tab — to get a general sense of trends. www.recenter.tamu.edu

- American Society of Farm Managers & Rural Appraisers (ASFMRA): See land value trends and links to state chapters that can provide local information. www.asfmra.org/resources/land-trends

- USDA: The agency publishes a summary of its annual survey on farm real estate values. www.nass.usda.gov

- Universities: Some schools have real estate centers and agriculture programs that publish information on local land trends.