Gathering the paperwork required for a new loan can be intimidating. But it pays to be prepared when meeting with your loan officer.

Whether you’re applying for a mortgage or an operating loan, you must meet specific eligibility and application requirements.

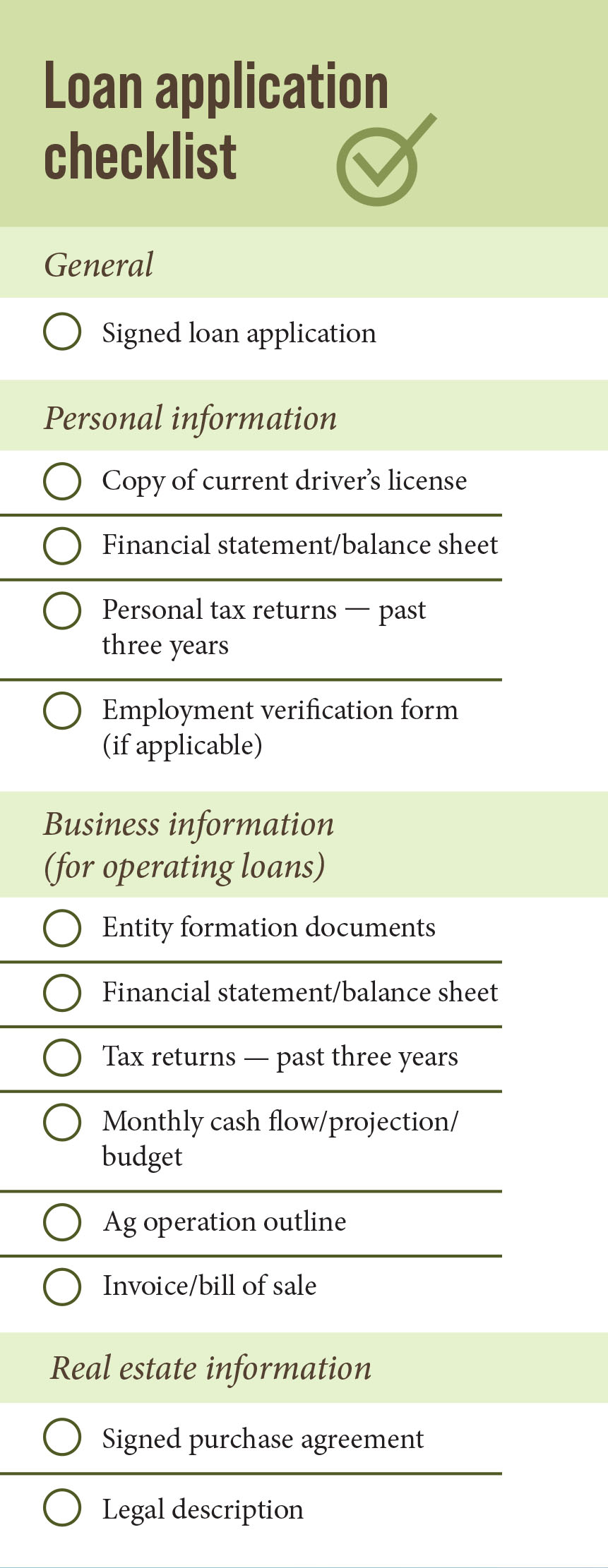

Many lenders will provide borrowers with a checklist of the information needed to complete the application.

These documents help your lender structure the best loan for you. And they “help the lender get to the end zone faster,” says Shane Hall, chief lending officer at Ag New Mexico.

Money Matters: Loan Application Checklist

Get organized

The first step in starting the loan application process is to get organized. Compile basic documents and financial records early.

This is the time to gather tax returns and financial statements, make copies and prepare for your meeting.

“Supporting documentation leads to a smoother application and approval process,” says Hall.

Paint a complete picture

If you’re a full-time farmer looking to buy more land, you may need to provide different documentation than the urbanite who is financing a hobby ranch.

But whatever your goals, your lender wants to know “where you’ve been, where you are and where you’re going,” says Jeff Bedwell of Central Texas Farm Credit. “Everything I require is going to answer those three questions.”

Let your lender help you

Your financial history and income projections indicate to a lender you have the ability to repay a loan.

“In ag, you don’t work 9 to 5 and make a set salary. The more documentation you can provide, the better,” says Bedwell, who is vice president and branch manager of the San Saba and Brady branches. “We don’t want to run a borrower through the wringer. But the documents allow us to see the best possible deal.”

10 questions to ask your lender before applying for a loan

- What documents do you need from me?

- How long will the application process take?

- Which loan is the best fit for my operation?

- How much is my down payment?

- What are the closing costs?

- What’s the current interest rate range?

- What are the loan terms?

- Is there a prepayment penalty?

- What type of collateral is needed for the loan?

- Is anything else required from me for this loan?

Ask questions

If you have a question, don’t hesitate to ask your lender.

“We welcome questions from the borrower,” says Bedwell. “It’s the only way to know both parties are on the same page and know what is expected.

“We’re putting together an action plan. Everyone must know what to expect from the other.”

– Staff